Fix-and-Flip: Real Estate Investing Demystified

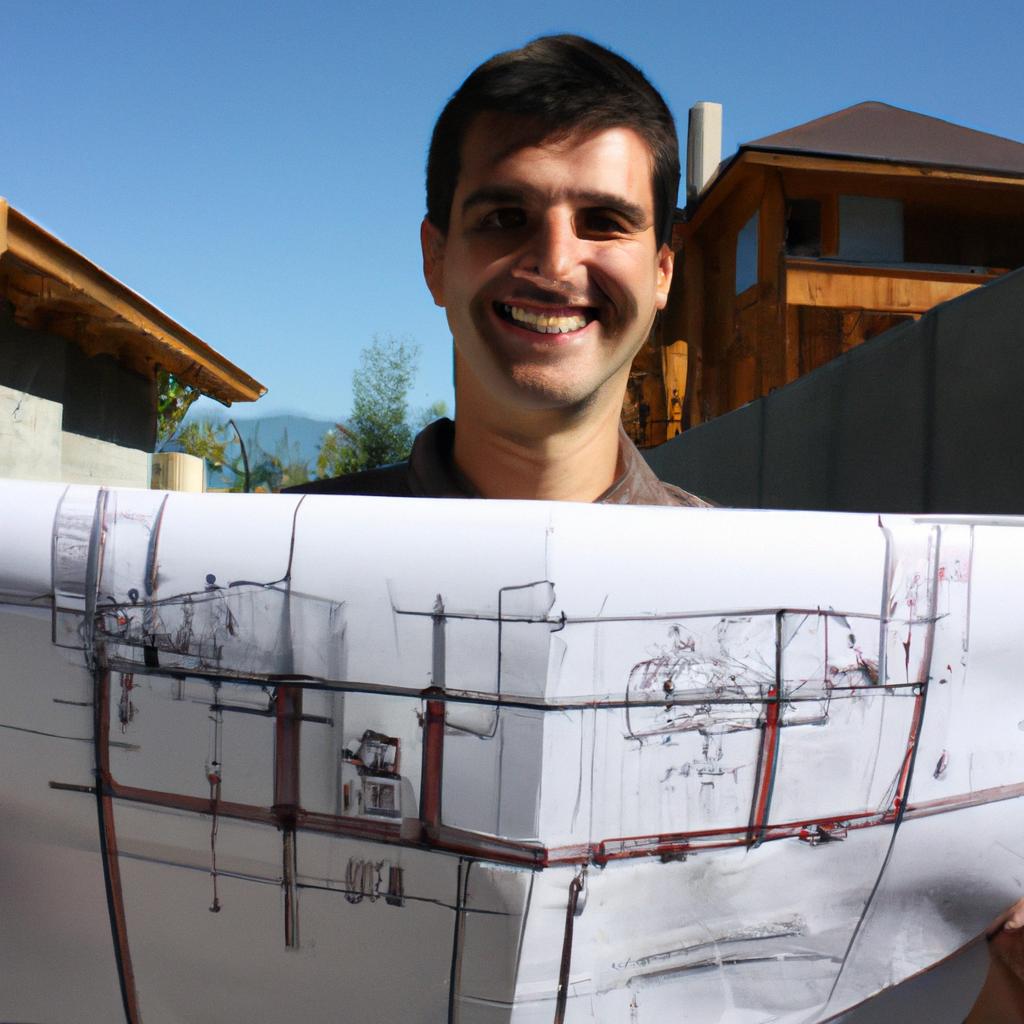

The world of real estate investing can be a complex and daunting one, filled with unfamiliar terms and strategies. However, one investment strategy that has gained popularity in recent years is fix-and-flip real estate investing. This strategy involves acquiring distressed properties at a low price, renovating them to increase their value, and then selling them for a profit.

For example, imagine an investor named John who purchases a rundown property in a desirable neighborhood. The house is in need of major repairs but is priced well below market value due to its condition. John sees the potential in this property and decides to take on the challenge of fixing it up. He invests time and money into renovations such as updating the kitchen, bathrooms, and improving the overall curb appeal. Once the renovations are complete, John lists the property for sale at a higher price than what he initially paid for it. Within weeks, he receives multiple offers from interested buyers and ultimately sells the property for a substantial profit.

Fix-and-flip real estate investing may seem like an intimidating venture to those unfamiliar with the industry. However, by understanding the key principles behind this investment strategy and following proven techniques, anyone can demystify this process and potentially achieve success in their own real estate endeavors. In this article , I will provide you with a comprehensive guide to fix-and-flip real estate investing. We will explore the essential steps involved in this strategy, from finding the right property to securing financing and managing renovations. Additionally, I will share tips and best practices to help you maximize your profit potential and minimize risks along the way.

-

Research and Analysis:

The first step in any successful fix-and-flip venture is conducting thorough research. This includes identifying target markets with strong appreciation potential, understanding local market conditions, analyzing comparable sales data, and assessing the demand for renovated properties in specific neighborhoods. By researching carefully, you can identify areas that offer attractive investment opportunities. -

Financing Options:

Once you have identified a potential property to flip, it’s crucial to secure appropriate financing. Traditional options include bank loans or mortgages, private lenders, hard money loans, or even using your own funds if available. Each option has its pros and cons, so it’s important to evaluate them based on interest rates, repayment terms, requirements for down payments or collateral, and overall affordability. -

Property Acquisition:

After securing financing, it’s time to find distressed properties that fit your investment criteria. This can be done through various channels such as working with real estate agents specializing in foreclosures or short sales, attending auctions or tax lien sales, networking with wholesalers or other investors who may have off-market deals. It’s essential to conduct thorough due diligence on each property before making an offer by inspecting its condition and estimating repair costs accurately. -

Renovation Strategy:

Once you’ve acquired a property, creating a detailed renovation strategy is crucial for success. This involves determining which repairs and upgrades are necessary to increase the property’s value while keeping within budget constraints. Consult contractors or industry professionals for accurate cost estimates and timelines of completion. Key areas often targeted for improvements include kitchens, bathrooms, flooring, paintwork as well as enhancing curb appeal. -

Efficient Project Management:

Effective project management is essential to ensure that renovations are completed on time and within budget. This involves coordinating with contractors, obtaining necessary permits, managing schedules, and monitoring progress regularly. Maintaining clear communication and staying organized will help minimize delays or cost overruns. -

Marketing and Sale:

Once renovations are complete, it’s time to list the property for sale. Effective marketing is crucial to attract potential buyers quickly. Professional photography, staging, and creating compelling listings can significantly enhance the property’s appeal. Pricing the property competitively based on market conditions and recent sales data will also increase the chances of a quick sale. -

Closing the Deal:

When receiving offers from interested buyers, carefully evaluate their terms and financial capabilities before accepting an offer. Ensure all necessary paperwork is in order and work closely with your real estate agent or attorney to navigate through the closing process smoothly.

By following these key steps and adapting them to your specific circumstances, you can increase your chances of success in fix-and-flip real estate investing. Remember that each investment opportunity comes with its unique set of challenges, so continuously educating yourself about market trends and industry best practices will allow you to make informed decisions along the way.

Understanding the Fix-and-Flip Strategy

To grasp the essence of the fix-and-flip strategy, let’s consider an example. Imagine a dilapidated property in need of significant repairs and renovations. A real estate investor purchases this distressed property at a discounted price with the intention to refurbish it and sell it at a higher value within a short time frame. This is precisely what defines the fix-and-flip strategy: buying properties that require repair work, improving them, and then reselling for profit.

The fix-and-flip strategy offers several advantages that make it an enticing investment option:

- Potential high returns: By purchasing undervalued or distressed properties and adding value through renovation efforts, investors have the potential to generate substantial profits when selling.

- Short-term investments: Unlike long-term buy-and-hold strategies, fix-and-flip projects typically aim for quick turnaround times. Investors can complete renovations efficiently and sell the property relatively swiftly, allowing for faster capital reinvestment.

- Flexibility in property selection: The fix-and-flip approach allows investors to choose from various types of properties such as single-family homes, condominiums, or even commercial buildings.

- Opportunity for creativity: Renovating properties provides room for creative expression and design choices while also allowing investors to align their vision with market demand.

| Factors Influencing Success | Challenges Faced by Investors | Skills Required |

|---|---|---|

| Thorough Market Research | Property Inspection | Construction Knowledge |

| Accurate Financial Analysis | Timely Project Management | Negotiation Abilities |

| Efficient Time Management | Unforeseen Repairs | Marketing Expertise |

| Effective Budgeting | Fluctuating Real Estate Market | Attention to Detail |

Considering these key factors alongside careful planning can significantly increase the chances of success in implementing a fix-and-flip strategy. Nevertheless, it is important to acknowledge that this investment approach also comes with its share of risks and challenges.

As we move forward into the subsequent section on “Key Factors to Consider Before Getting Started,” let us delve deeper into crucial considerations that potential fix-and-flip investors need to keep in mind. By addressing these factors, individuals can make informed decisions and navigate the real estate market effectively while implementing their plans for successful property renovations and resale ventures.

Key Factors to Consider Before Getting Started

Transitioning from the understanding of the fix-and-flip strategy, it is crucial to evaluate several key factors before diving into real estate investing. To illustrate these considerations, let’s explore a hypothetical scenario involving an aspiring investor named Sarah.

Sarah has recently decided to venture into the world of fix-and-flip properties. She envisions purchasing a distressed property, renovating it tastefully, and selling it for a substantial profit. However, before embarking on her new endeavor, she needs to carefully analyze various aspects that can significantly impact her success as an investor.

Firstly, one must assess their financial readiness. Real estate investments require capital not only for purchasing properties but also for renovations and unexpected expenses along the way. Sarah must determine if she possesses sufficient funds or access to financing options suitable for this undertaking. It is essential to create a sound budget encompassing all potential costs involved in each project.

Secondly, market analysis plays a pivotal role in identifying profitable opportunities. Evaluating trends in specific areas will guide Sarah towards locations where demand exceeds supply, maximizing her chances of obtaining higher returns on investment. Furthermore, conducting thorough research regarding local regulations and zoning laws ensures compliance with legal requirements throughout the entire process.

Lastly, building a reliable network of professionals is vital for successful fix-and-flip ventures. Collaborating with experienced contractors, architects, and real estate agents provides valuable expertise during different stages of the projects. Additionally, establishing relationships with reputable suppliers guarantees timely access to quality materials at competitive prices.

Considering these key factors allows investors like Sarah to make informed decisions when entering the fix-and-flip realm. By comprehensively examining their financial situation, analyzing market conditions diligently, and cultivating trustworthy connections within the industry; individuals increase their likelihood of achieving lucrative results through strategic real estate investing.

In the subsequent section about “Finding the Right Property to Fix and Flip,” we will delve deeper into strategies for identifying the most promising properties in which to invest.

Finding the Right Property to Fix and Flip

Once you have considered the key factors involved in fix-and-flip real estate investing, it is time to move on to finding the right property that aligns with your investment goals. To illustrate this process, let’s consider a hypothetical case study of an investor named John who wants to purchase a distressed property for fixing and flipping.

When searching for properties suitable for fix-and-flip projects, there are several important aspects to keep in mind:

-

Location: The location of the property plays a crucial role in determining its potential profitability. Look for areas with high demand from homebuyers or renters, preferably with good schools, amenities, and low crime rates. This will increase the chances of selling the renovated property quickly at a higher price.

-

Condition: Identify properties that require moderate renovations rather than extensive structural repairs. While cosmetic upgrades like new paint, flooring, and kitchen remodels are relatively manageable, major repairs such as foundation issues or roof replacements can significantly impact your budget and timeline.

-

Purchase Price: It is essential to find properties that can be acquired below market value. Negotiating skills and thorough research can help you secure a better deal. Consider working closely with experienced real estate agents or wholesalers who specialize in distressed properties to gain access to off-market deals.

-

Market Trends: Stay up-to-date with current market trends and analyze comparable sales data in the target area. Understanding recent sale prices of similar renovated homes will provide insights into potential profits after factoring in acquisition costs, renovation expenses, financing charges, holding costs, and anticipated selling price.

To further emphasize these considerations, here is a table highlighting their significance:

| Factors | Importance |

|---|---|

| Location | High |

| Condition | Moderate |

| Purchase Price | High |

| Market Trends | High |

By carefully evaluating these factors when searching for properties, you increase the likelihood of finding a suitable fix-and-flip opportunity.

In this new section about “Calculating the Potential Profitability of a Fix-and-Flip,” we will explore how to evaluate financial aspects such as renovation costs, expected returns on investment, and determining an optimal selling price without assuming any specific steps or sequences.

Calculating the Potential Profitability of a Fix-and-Flip

Section H2: Calculating the Potential Profitability of a Fix-and-Flip

In the previous section, we discussed the importance of finding the right property to fix and flip. Now, let’s dive into another crucial aspect of real estate investing – calculating the potential profitability of a fix-and-flip project.

To better understand this process, consider an example scenario. Imagine you come across a house in a desirable neighborhood that is listed for $200,000. After conducting thorough research on similar properties in the area, you estimate that after repairs and renovations, you could sell it for around $300,000. However, before making any decisions, it is essential to calculate all associated costs accurately.

When analyzing the potential profitability of your fix-and-flip project, take these factors into account:

- Purchase price: The initial cost of acquiring the property.

- Renovation costs: Expenses related to repairs, upgrades, and improvements needed to increase its market value.

- Holding costs: Monthly expenses such as mortgage payments, insurance fees, utilities, taxes during renovation time until sale completion.

- Selling costs: Fees associated with selling the property including agent commissions and closing costs.

By creating a comprehensive table like the one below outlining each expense category along with estimated amounts or percentages based on market averages can help you evaluate your potential profit margin more effectively:

| Expense Category | Estimated Amount/Percentage |

|---|---|

| Purchase Price | $200,000 |

| Renovation Costs | $50,000 |

| Holding Costs | 8% |

| Selling Costs | 6% |

This table allows you to see clearly where your money will be allocated throughout the process while giving you an idea of what percentage of total expenses each category represents.

Considering all these factors and using accurate estimates will enable you to determine whether the projected profits outweigh the overall investment required for your fix-and-flip project. It is important to note that unexpected expenses may arise during the renovation process, so it’s wise to keep a contingency fund.

With a thorough understanding of how to calculate potential profitability in hand, you can now move on to securing financing for your fix-and-flip project. This step will be discussed further in the next section.

Securing Financing for Your Fix-and-Flip Project

Case Study:

To better understand how to analyze the potential profitability of a fix-and-flip project, let’s consider a hypothetical example. Imagine you come across a property in need of repairs that is listed for $200,000. After conducting market research and estimating renovation costs, you determine that the after-repair value (ARV) of the property would be around $300,000. This means that if all goes well, you could potentially make a profit of $100,000 on this investment.

Analyzing Profitability:

When evaluating whether a fix-and-flip project is financially viable, it’s crucial to consider several factors:

-

Purchase Price: The initial cost of acquiring the property plays a significant role in determining its potential profitability. Negotiating a good purchase price can directly impact your overall return on investment (ROI).

-

Renovation Costs: Carefully estimate the costs associated with renovating and repairing the property. These expenses include labor, materials, permits, and any unforeseen issues that may arise during construction.

-

Holding Costs: Calculate the carrying costs involved in holding onto the property until it sells. These expenses typically encompass utilities, insurance premiums, property taxes, loan interest payments, and maintenance fees.

-

Market Conditions: Stay informed about local real estate trends and market conditions to gauge demand for properties similar to yours. A favorable market will increase your chances of selling quickly at or above your projected ARV.

Profit Analysis Table:

Consider this sample table as an aid when analyzing the financial aspects of your fix-and-flip project:

| Factor | Cost ($) |

|---|---|

| Purchase Price | 200,000 |

| Renovation Costs | 70,000 |

| Holding Costs | 10,500 |

| Projected Selling Price | 300,000 |

| Total Investment | 280,500 |

| Potential Profit (ARV – Total Investment) | 19,500 |

By carefully evaluating these factors and conducting a thorough analysis, you can make informed decisions about the potential profitability of your fix-and-flip investment.

[Transition into the subsequent section: Effective Strategies for Successful Fix-and-Flip Deals] With a solid understanding of how to assess the profitability of a fix-and-flip project in mind, it is now time to delve into effective strategies that can help maximize your chances of success.

Effective Strategies for Successful Fix-and-Flip Deals

Building upon the foundation of securing financing for your fix-and-flip project, it is crucial to implement effective strategies that will maximize the potential for successful deals. By employing carefully devised methods, investors can navigate through the complexities of real estate investing and achieve profitable outcomes. This section aims to demystify the process further by exploring key strategies utilized in fix-and-flip ventures.

One way to increase profitability is by conducting thorough market research. For instance, consider a hypothetical scenario where an investor identifies a promising neighborhood with high demand for renovated properties. This information informs their decision-making process, enabling them to select properties strategically and focus on areas likely to yield attractive returns.

To ensure success in fix-and-flip projects, attention must be given to property acquisition. Investors should actively seek out distressed or undervalued properties that have potential for improvement. By purchasing such assets at below-market prices, significant profit margins can be generated upon completion of renovations. Moreover, establishing reliable connections within the real estate industry can provide access to off-market opportunities which may offer even greater investment potential.

Effective management of renovation costs is another critical aspect of fix-and-flip ventures. To control expenses without compromising quality, investors must develop comprehensive budgets and diligently track all expenditures throughout the renovation process. Implementing cost-saving measures like negotiating favorable contracts with contractors and suppliers can contribute significantly to overall profitability.

Additionally, fostering positive relationships with local professionals such as contractors, architects, and inspectors plays a vital role in ensuring smooth project execution. Collaborating closely with these individuals helps maintain clear lines of communication and facilitates timely progress updates during each phase of the renovation journey.

- The thrill of transforming neglected properties into desirable homes

- The satisfaction derived from seeing tangible improvements come to life

- The sense of accomplishment when successfully selling a renovated property

- The financial rewards gained from astute investment decisions

| Strategies | Benefits | Challenges |

|---|---|---|

| Thorough market research | Identifying high-demand neighborhoods | Time-consuming |

| Strategic property acquisition | Increased profit margins | Limited availability |

| Cost-effective renovation management | Maximizing profitability | Potential quality compromises |

By implementing these strategies, investors can navigate the fix-and-flip landscape with greater confidence. Engaging in thorough market research, identifying strategic properties, managing renovation costs effectively, and fostering positive relationships are all key components of a successful project. By employing these techniques, investors can unlock the potential for profitable returns on their real estate investments.